|

Press Release

Date: 15-Aug-23 PACRA Assigns Star Ranking to NBP Sarmaya Izafa Fund

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 13 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (15-Aug-23) | Previous (10-Feb-23) | |

| Ranking | 3-Star | 3-Star | |

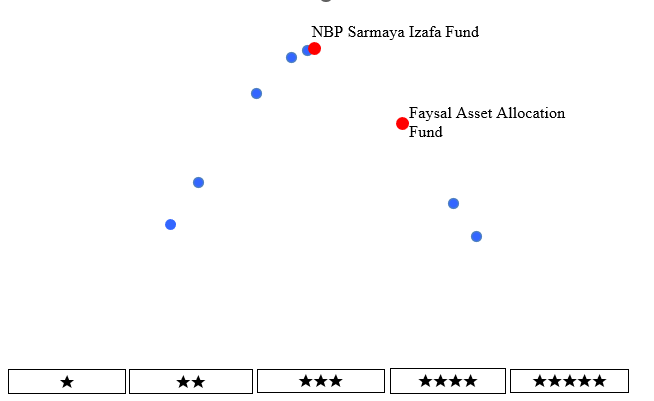

| Rating Rationale |

During FY23 the KSE-100 and KSE-30 index declined by -7.39% and -0.21% whereas KMI-30 improved by ~2.88%. The overall market declined due to numerous economic challenges, delays in the resumption of the IMF programmed, a growing fiscal deficit, soaring inflation, and increase in the policy rate. PACRA ranked funds comprise of two funds among the universe of thirteen funds. The category average showed a positive return of ~6.71%. While top performing fund in the category showed a return of ~22.16%. NBP Sarmaya Izafa Fund ranked 3 Star. Total return of NBP Sarmaya Izafa Fund in 1-year is ~2.63% which performed significantly well from stock market negative return of -7.39%. In the end Jun'23, Fund's generate income by investing ~70.8% in Equities, ~19.7% in cash whereas ~5.9% in TFC/Sukuk. The Fund always managed to handle the redemption pressure by retaining enough liquidity in the form of cash. Sector wise Fund invested ~14% in Oil & Gas Exploration Companies, ~7.5% in Cement, ~8.2% in Fertilizers. Whereas ~4.6% in Power Generation & Distribution, ~18.8% in Commercial Banks and ~17.3% in others at the end Jun'23

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Wajeeha Asghar wajeeha.asghar@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jun-22 |

Sector Study | Mutual Funds | Feb-23 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

Date: 15-Aug-23 PACRA Assigns Star Ranking to NBP Sarmaya Izafa Fund

3-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 13 | ||

| Performance Period | 3-Year | ||

| Dissemination Date | Current (15-Aug-23) | Previous (10-Feb-23) | |

| Ranking | 3-Star | 3-Star | |

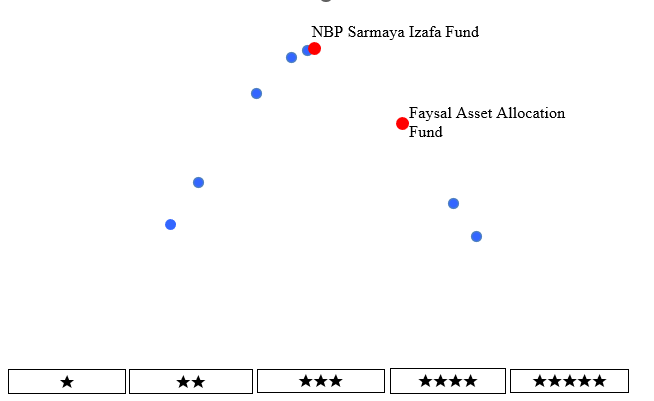

| Rating Rationale |

During 3-year the overall market declined due to numerous economic challenges, delays in the resumption of the IMF programmed, a growing fiscal deficit, soaring inflation, and increase in the policy rate. PACRA ranked funds comprise of two funds among the universe of thirteen funds. The category average showed a return of ~20.3%. While top performing fund in 3-Year of the category showed a return of ~52.5%. NBP Sarmaya Izafa Fund ranked 3 Star. Total return of NBP Sarmaya Izafa Fund in 3-year is ~12.5% which performed well from the stock market negative return of -1.52%. In the end Jun'23, Fund's generate income by investing ~70.8% in Equities, ~19.7% in cash whereas ~5.9% in TFC/Sukuk. The Fund always managed to handle the redemption pressure by retaining enough liquidity in the form of cash. Sector wise Fund invested ~14% in Oil & Gas Exploration Companies, ~7.5% in Cement, ~8.2% in Fertilizers. Whereas ~4.6% in Power Generation & Distribution, ~18.8% in Commercial Banks and ~17.3% in others at the end Jun'23.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Wajeeha Asghar wajeeha.asghar@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jun-22 |

Sector Study | Mutual Funds | Feb-23 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

Date: 15-Aug-23 PACRA Assigns Star Ranking to NBP Sarmaya Izafa Fund

5-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 13 | ||

| Performance Period | 5-Year | ||

| Dissemination Date | Current (15-Aug-23) | Previous (10-Feb-23) | |

| Ranking | 3-Star | 3-Star | |

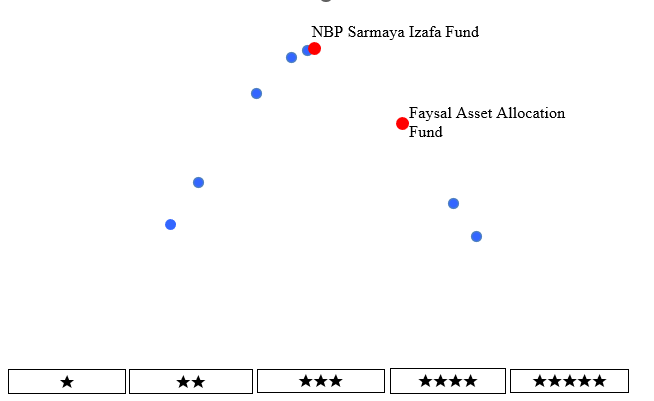

| Rating Rationale |

During 5-year the overall market declined due to numerous economic challenges, delays in the resumption of the IMF programmed, a growing fiscal deficit, soaring inflation, and increase in the policy rate. PACRA ranked funds comprise of two funds among the universe of thirteen funds. The category average showed a return of ~13.4%. While top performing fund in 5-Year of the category showed a return of ~42%. NBP Sarmaya Izafa Fund ranked 3 Star. Total return of NBP Sarmaya Izafa Fund in 5-year is ~11.2%. The year 2020 was a year of severe distress due to Covid which impacted the stock market significantly with negative returns of -28.8%. Resultantly, the year also impacted the Fund's return which is also evident from 3-Years cumulative returns. In the end Jun'23, Fund's generate income by investing ~70.8% in Equities, ~19.7% in cash whereas ~5.9% in TFC/Sukuk. The Fund always managed to handle the redemption pressure by retaining enough liquidity in the form of cash. Sector wise Fund invested ~14% in Oil & Gas Exploration Companies, ~7.5% in Cement, ~8.2% in Fertilizers. Whereas ~4.6% in Power Generation & Distribution, ~18.8% in Commercial Banks and ~17.3% in others at the end Jun'23.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Wajeeha Asghar wajeeha.asghar@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jun-22 |

Sector Study | Mutual Funds | Feb-23 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |