|

Press Release

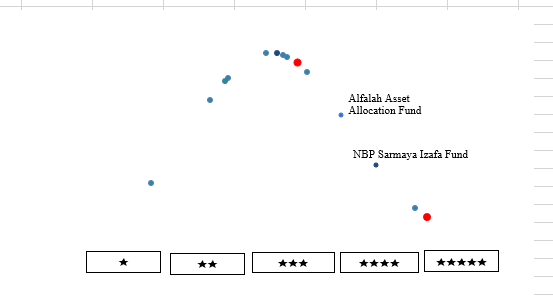

Date: 25-Sep-25 PACRA Assigns Star Ranking to NBP Sarmaya Izafa Fund

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 11 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (25-Sep-25) | Previous (28-Feb-25) | |

| Ranking | 4-Star | 4-Star | |

| Rating Rationale |

In FY25, Pakistan’s equity market rallied sharply, with the KSE-100 up ~60.15%, KSE-30 ~50.94%, and KMI-30 ~46.23%, supported by macroeconomic stabilization and pro-market policy shifts. The IMF’s EFF review and RSF approval unlocked over USD 2.4 B in funding, while SBP cut policy rates by 1,100 bps, driving a valuation re-rating. SBP reserves rose to USD 14.51 B (vs USD 9.39 B YoY), meeting IMF benchmarks, as the PKR remained stable on the back of portfolio inflows, loans, and multilateral support. A post-ceasefire boost in investor confidence, easing macro uncertainty, and improved global sentiment reinforced broad-based market gains. In the Asset Allocation category, PACRA rated two out of thirteen funds, with the category returning ~41.26% on average. NBP Sarmaya Izafa Fund outperformed, delivering a 58.08% return and earning a 4-Star rating. The top-performer of the Fund generating a return of ~69.42%. The portfolio allocation of the Fund included ~83.4% in equities, ~11.6% in cash, ~3.0% in TFC/Sukuk, and ~2.0% in other assets. The Fund was diversified across sectors, with key allocations in Commercial Banks (~16.9%), Oil & Gas (~16.2%), Fertilizers (~13.0%), and Cement (~10.3%). The Fund effectively managed liquidity and capitalized on market opportunities.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

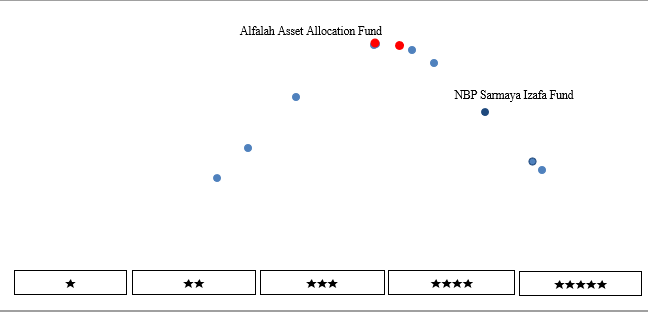

Date: 25-Sep-25 PACRA Assigns Star Ranking to NBP Sarmaya Izafa Fund

3-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 11 | ||

| Performance Period | 3-Year | ||

| Dissemination Date | Current (25-Sep-25) | Previous (28-Feb-25) | |

| Ranking | 4-Star | 4-Star | |

| Rating Rationale |

In the preceding triennium, Pakistan’s capital markets faced challenges such as IMF delays, fiscal deficits, political instability, and inflation fluctuations, causing volatility. This affected investor sentiment, leading to varied fund performances within the Asset Allocation category, which posted an average return of ~116.57%, while NBP Sarmaya Izafa Fund was out performed and generate a return of ~178.3% and earning a 4-Star rating. The portfolio allocation of the Fund included ~83.4% in equities, ~11.6% in cash, ~3.0% in TFC/Sukuk, and ~2.0% in other assets. The Fund was diversified across sectors, with key allocations in Commercial Banks (~16.9%), Oil & Gas (~16.2%), Fertilizers (~13.0%), and Cement (~10.3%). The Fund effectively managed liquidity and capitalized on market opportunities.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

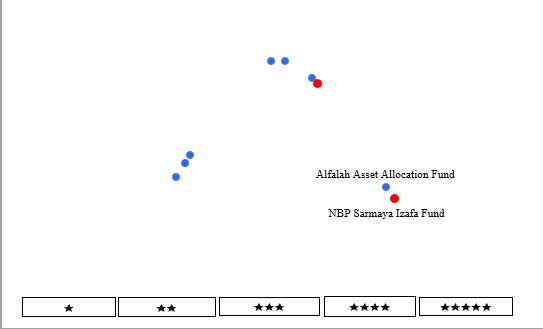

Date: 25-Sep-25 PACRA Assigns Star Ranking to NBP Sarmaya Izafa Fund

5-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 11 | ||

| Performance Period | 5-Year | ||

| Dissemination Date | Current (25-Sep-25) | Previous (28-Feb-25) | |

| Ranking | 4-Star | 4-Star | |

| Rating Rationale |

Over the five-year horizon, Pakistan’s equity markets experienced significant volatility driven by macroeconomic imbalances, currency depreciation, and political uncertainty. Despite these challenges, a strong bull run in FY25 restored investor confidence and lifted overall returns. PACRA evaluated thirteen Funds in asset allocation category

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |