|

Press Release

Date: 25-Sep-25 PACRA Assigns Star Ranking to NBP Balanced Fund

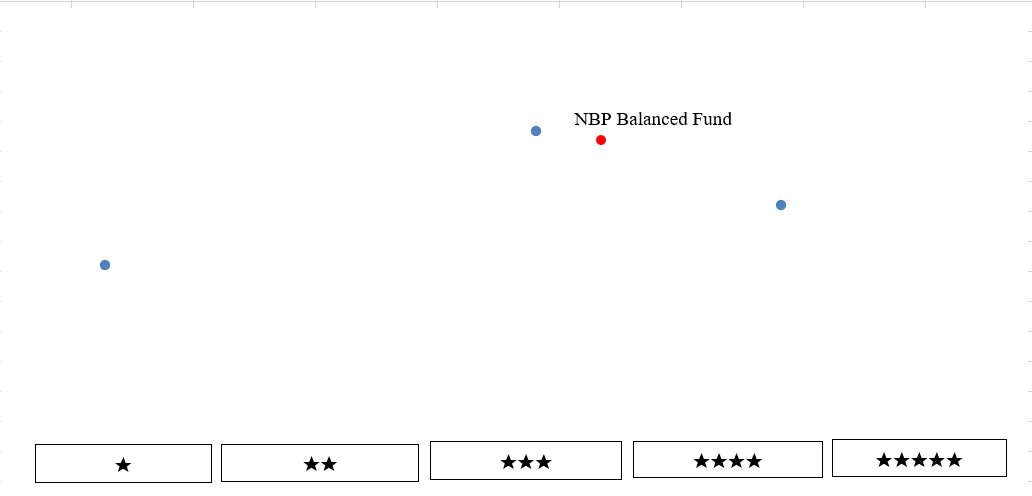

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Balanced Fund | ||

| Total Fund In Category | 4 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (25-Sep-25) | Previous (28-Feb-25) | |

| Ranking | 4-Star | 4-Star | |

| Rating Rationale |

In FY25, the KSE-30 Index rose ~50.9%, supported by macroeconomic stability, monetary easing, and improved investor sentiment. The Balanced Fund category benefited as equity allocations gained from the SBP’s 1,100 bps rate cut, while fixed-income positions ensured portfolio stability. Key drivers included the IMF’s USD 1B disbursement, USD 1.4B RSF approval, and a rise in SBP reserves to USD 14.51B, surpassing IMF targets. A stable PKR, sustained foreign inflows, and a post-ceasefire rebound in confidence further supported equities, allowing the Fund to capture upside while maintaining balance. Within the Balanced Fund category, PACRA rated one out of four funds, with the category’s average return at ~45.37%. The NBP Balanced Fund earned a 4-Star rating, delivering a 1-year return of ~49.16%, modestly trailing the KSE-100's 60% gain due to its diversified asset allocation and risk-managed approach. As of June 2025, the Fund maintained ~67.2% exposure to equities, ~26.3% in cash, ~2.2% in TFCs/Sukuks, and ~4.3% in other instruments. Major sector allocations included ~13.9% in Oil & Gas Exploration, ~11.9% in Commercial Banks, ~9.9% in Cement, ~9.8% in Fertilizers, and ~4.6% in Textiles, with ~17.1% spread across other sectors. The Fund's strategy focused on balancing growth and liquidity, helping it navigate short-term volatility while capturing long-term upside.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-25 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

Date: 25-Sep-25 PACRA Assigns Star Ranking to NBP Balanced Fund

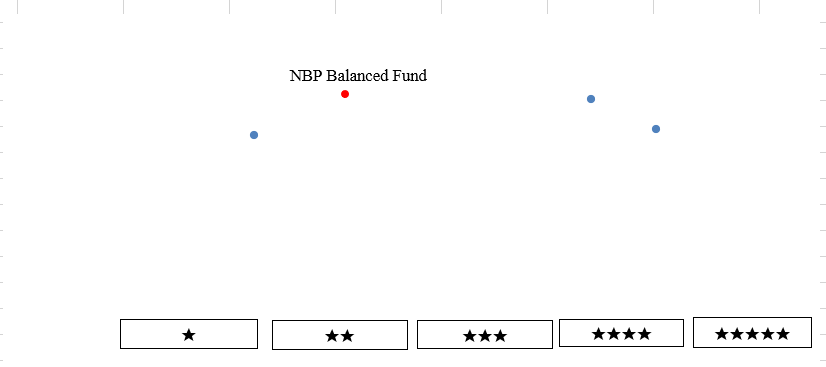

3-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Balanced Fund | ||

| Total Fund In Category | 4 | ||

| Performance Period | 3-Year | ||

| Dissemination Date | Current (25-Sep-25) | Previous (28-Feb-25) | |

| Ranking | 3-Star | 3-Star | |

| Rating Rationale |

Over the past three years, Pakistan’s market navigated persistent inflation, currency devaluation, external financing constraints, and prolonged political uncertainty, alongside a consistently high interest rate environment. Despite this, the Balanced Fund category showed resilience, with the average return at ~144%. The top fund returned ~160%, and NBP Balanced Fund received a 2-Star rating, posting a return of ~133%. As of Jun'25, the Fund’s allocation included ~67.2% in equities, ~26.3% in cash, ~2.2% in TFCs/Sukuks, and ~4.3% in other instruments. Sector-wise, it had ~13.9% in Oil & Gas Exploration, ~11.9% in Commercial Banks, ~9.9% in Cement, ~9.8% in Fertilizers, and ~4.6% in Textiles. The remaining 17.1% was diversified across other sectors. The decline to 2-Stars reflects the Fund’s underperformance, evidenced by the lowest returns relative to its peers over the past two years.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-25 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

Date: 25-Sep-25 PACRA Assigns Star Ranking to NBP Balanced Fund

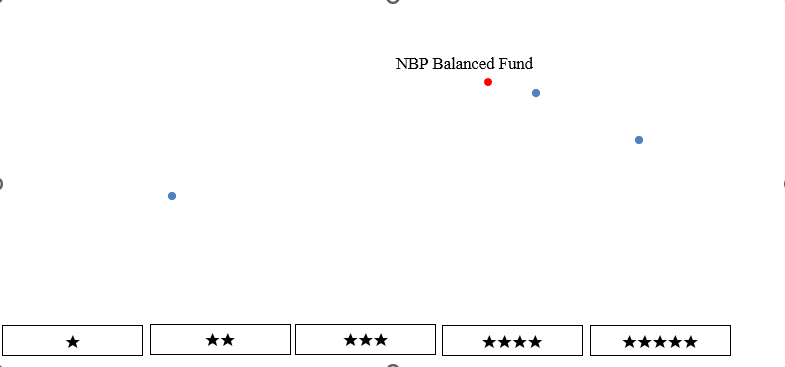

5-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Balanced Fund | ||

| Total Fund In Category | 4 | ||

| Performance Period | 5-Year | ||

| Dissemination Date | Current (25-Sep-25) | Previous (28-Feb-25) | |

| Ranking | 3-Star | 4-Star | |

| Rating Rationale |

Over the past five years, Pakistan’s capital markets faced structural and macroeconomic challenges, including IMF delays, fiscal imbalances, political uncertainty, and inflation volatility. Currency depreciation, a widening current account deficit, and fluctuating interest rates also impacted investor sentiment. Within the Balanced Fund category, PACRA rated one out of every four funds. The average five-year return for the category stood at ~163%, with the top-performing fund delivering ~185%. NBP Balanced Fund posted a return of ~160%, closely aligning with the category average, while the lowest-performing fund in the group recorded a return of ~140%. As of Jun'25, the Fund’s allocation included ~67.2% in equities, ~26.3% in cash, ~2.2% in TFCs/Sukuks, and ~4.3% in other instruments. Sector-wise, it had ~13.9% in Oil & Gas Exploration, ~11.9% in Commercial Banks, ~9.9% in Cement, ~9.8% in Fertilizers, and ~4.6% in Textiles. The remaining ~17.1% was diversified across other sectors. The decline to 3-Stars reflects the Fund’s underperformance, evidenced by the lowest returns relative to its peers over the past three years.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-25 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |