|

Press Release

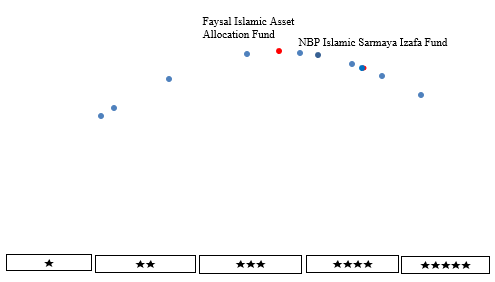

Date: 28-Feb-25 PACRA ASSIGNS STAR RANKING TO NBP ISLAMIC SARMAYA IZAFA FUND

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Islamic Asset Allocation | ||

| Total Fund In Category | 12 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (28-Feb-25) | Previous (13-Aug-24) | |

| Ranking | 3-Star | 3-Star | |

| Rating Rationale |

In CY24, Pakistan’s equity market saw a strong bull run, with KSE-100, KSE-30, and KMI-30 indices gaining ~84.36%, 74.47%, and ~70.56%, respectively. Key macroeconomic factors like IMF program approval, monetary easing, foreign investor interest, PKR/USD stabilization, and rising foreign reserves (USD 15.9B by Dec'24) fueled this rally. PACRA assigned star ratings to two funds in the Islamic asset allocation category, with NBP Islamic Sarmaya Izafa Fund receiving a 3-star rating. The Fund returned ~74.84%, closely matching the top-performing fund but lagging the broader equity market. By Dec'24, ~80.7% of the Fund was in equities, ~18.5% in cash, and ~0.8% in other assets, ensuring liquidity management. Sector-wise, the Fund was heavily allocated to Oil & Gas Exploration (33.3%), followed by Cement, Fertilizers, Oil & Gas Marketing, and Power Generation. The remaining 18.8% was diversified across other sectors, strengthening its resilience. Strategic rebalancing will be key to improving the Fund’s positioning and optimizing returns.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

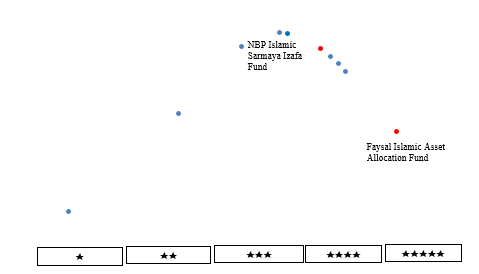

Date: 28-Feb-25 PACRA ASSIGNS STAR RANKING TO NBP ISLAMIC SARMAYA IZAFA FUND

3-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Islamic Asset Allocation | ||

| Total Fund In Category | 12 | ||

| Performance Period | 3-Year | ||

| Dissemination Date | Current (28-Feb-25) | Previous (13-Aug-24) | |

| Ranking | 3-Star | 3-Star | |

| Rating Rationale |

Over the past three years, Pakistan’s capital markets faced volatility from IMF delays, fiscal deficits, political uncertainty, and inflation fluctuations. Despite this, the Islamic asset allocation category showed resilience, with PACRA ranking two funds out of twelve. The category’s average return was ~71.64%, with the top fund returning ~168.20%. NBP Islamic Sarmaya Izafa Fund earned a 3-star rating, delivering a 3-year return of ~132.14%. The Fund focused on growth while maintaining liquidity buffers, with ~80.7% in equities, ~18.5% in cash, and ~0.8% in other assets. Sector-wise, it had the largest allocation in Oil & Gas Exploration (~33.3%), followed by Cement (~11%), Fertilizers (~8.4%), Oil & Gas Marketing (~4.7%), and Power Generation (~4.5%). The remaining 18.8% was diversified across other sectors, enhancing stability. The Fund’s strategic allocation balanced risk and return, with tactical reallocation key for future performance.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

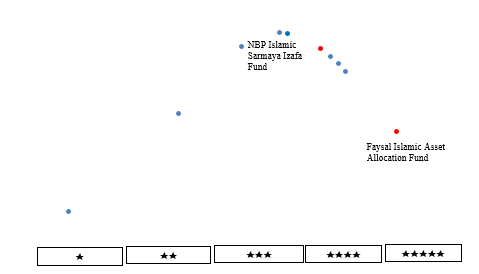

Date: 28-Feb-25 PACRA ASSIGNS STAR RANKING TO NBP ISLAMIC SARMAYA IZAFA FUND

5-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Islamic Asset Allocation | ||

| Total Fund In Category | 12 | ||

| Performance Period | 5-Year | ||

| Dissemination Date | Current (28-Feb-25) | Previous (13-Aug-24) | |

| Ranking | 3-Star | 4-Star | |

| Rating Rationale |

Over the past five years, Pakistan’s capital markets faced structural and macroeconomic challenges, including delays in the IMF program, fiscal imbalances, political instability, and volatility in policy rates and inflation. Currency depreciation, a widening current account deficit, and fluctuating interest rates impacted investor sentiment and liquidity. Despite these, NBP Islamic Sarmaya Izafa Fund emerged as the top performer in the Islamic asset allocation category, returning ~157.38%, outperforming the category average of ~93.81%. However, its PACRA rating was downgraded from 4 stars to 3 stars due to a relative decline in risk-adjusted returns and performance consistency. As of Dec’24, the Fund had ~80.7% in equities, ~18.5% in cash, and ~0.8% in other assets, balancing growth and liquidity. The portfolio concentrated in key sectors, with Oil & Gas Exploration at ~33.3%, followed by Cement (~11%), Fertilizers (~8.4%), Oil & Gas Marketing (~4.7%), and Power Generation (~4.5%). The remaining 18.8% was diversified across other sectors, enhancing risk mitigation. The Fund’s strong performance highlights its potential, but its rating indicates a need for better volatility management and consistency. Strategic rebalancing and sectoral repositioning will be key to regaining its competitive edge.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |