|

Press Release

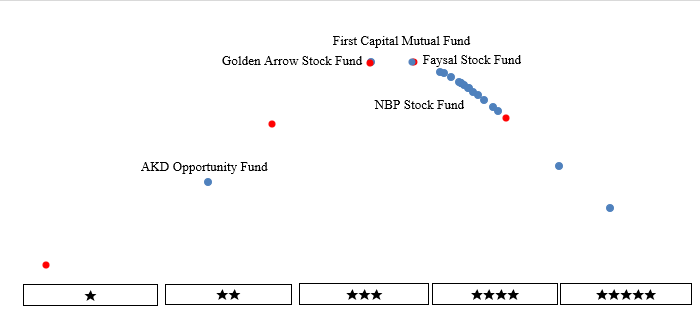

Date: 27-May-25 PACRA Assigns Star Raking to AKD Opportunity Fund

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Equity Fund (Open-end) | ||

| Total Fund In Category | 24 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (27-May-25) | Previous (15-Aug-24) | |

| Ranking | 2-Star | 2-Star | |

| Rating Rationale |

During CY24, Pakistan’s equity market surged due to macroeconomic stabilization, and monetary easing. The KSE-100, KSE-30, and KMI-30 indices gained ~84.36%, 74.15%, and ~70.56%, respectively. The Equity Fund category averaged ~69.65%, with the highest performer at ~119.12%. AKD Opportunity Fund posted a 1-year return of ~46.99%, lagging behind the category average and benchmark index, maintaining its 2-Star rating. At the end of December 2024, the exposure in Equities was ~93.91% and ~5.43% in cash for liquidity. Sector allocation focused on Inv. Banks / Inv. Cos. / Securities Cos. (~27.60%), Textile Spinning (~13.71%), Insurance (~11.34%), Technology & Communication (~9.58%), and Refinery (~7.37%), with ~24.31% spread across other sectors. Despite diversification, the Fund underperformed relative to category leaders. Liquidity management ensured operational flexibility. A recalibrated investment strategy is required to improve returns and competitiveness.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Tasveeb Idrees Tasveeb.Idrees@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

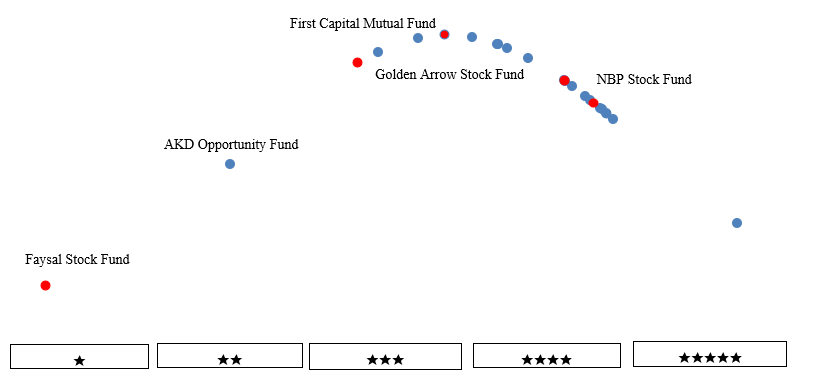

Date: 27-May-25 PACRA Assigns Star Raking to AKD Opportunity Fund

3-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Equity Fund (Open-end) | ||

| Total Fund In Category | 24 | ||

| Performance Period | 3-Year | ||

| Dissemination Date | Current (27-May-25) | Previous (15-Aug-24) | |

| Ranking | 2-Star | 2-Star | |

| Rating Rationale |

Over the three-year horizon, Pakistan’s capital markets faced turbulence due to policy uncertainty, fiscal imbalances, and inflationary pressures. Delays in the IMF program and exchange rate volatility further impacted investor sentiment, leading to varied fund performances. Despite these challenges, the Equity Fund category averaged ~108.73%, with the highest performer reaching ~213.38%. AKD Opportunity Fund, however, posted a three-year return of ~39.79%, significantly underperforming the category average and top-quartile funds, maintaining its 2-Star rating. At the end of December 2024, the exposure in Equities was ~93.91% and ~5.43% in cash for liquidity. Sector allocation was concentrated in Inv. Banks / Inv. Cos. / Securities Cos. (~27.60%), Textile Spinning (~13.71%), Insurance (~11.34%), Technology & Communication (~9.58%), and Refinery (~7.37%), with ~24.31% spread across other sectors. While the Fund maintained diversified exposure, its returns lagged behind peers. The underperformance underscores the need for improved risk-adjusted strategies to enhance competitiveness.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Tasveeb Idrees Tasveeb.Idrees@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

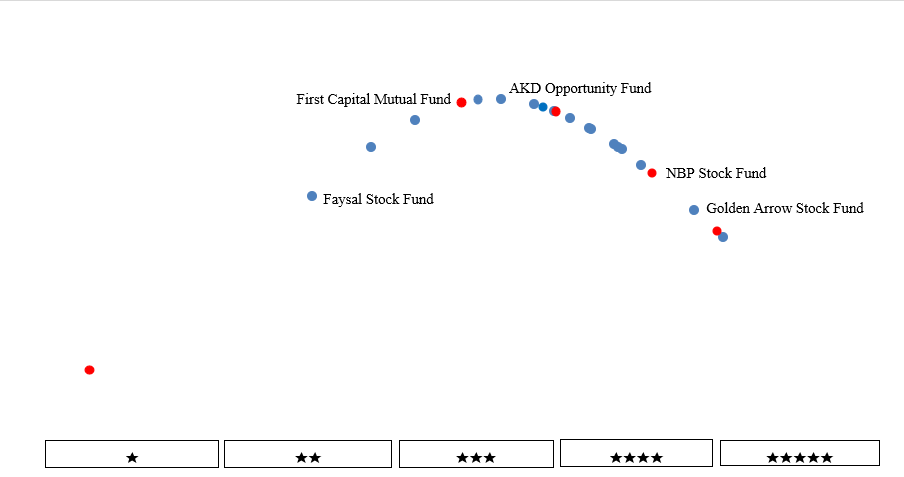

Date: 27-May-25 PACRA Assigns Star Raking to AKD Opportunity Fund

5-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Equity Fund (Open-end) | ||

| Total Fund In Category | 24 | ||

| Performance Period | 5-Year | ||

| Dissemination Date | Current (27-May-25) | Previous (15-Aug-24) | |

| Ranking | 3-Star | 3-Star | |

| Rating Rationale |

Over the five-year horizon, Pakistan’s equity markets faced volatility, macroeconomic imbalances, currency depreciation, and political instability. Despite these challenges, a strong bull run in CY24 saw the KSE-100, KSE-30, and KMI-30 gain ~84.36%, 74.15%, and 70.56%, respectively, restoring investor confidence. PACRA evaluated twenty-four Equity Funds, with the category averaging ~130.62% and the top performer reaching ~214.82%. AKD Opportunity Fund posted a ~118% return, maintaining its 3-Star rating but underperforming peers. At the end of December 2024, the exposure in Equities was ~93.91% and ~5.43% in cash for liquidity. Major sector allocations included Inv. Banks / Inv. Cos. / Securities Cos. (~27.60%), Textile Spinning (~13.71%), Insurance (~11.34%), Technology & Communication (~9.58%), and Refinery (~7.37%), with ~24.31% in other sectors. Despite diversification, the Fund’s performance lagged, highlighting the need for refined sector rotation, improved stock selection, and stronger risk management to enhance competitiveness.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Tasveeb Idrees Tasveeb.Idrees@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |