|

Press Release

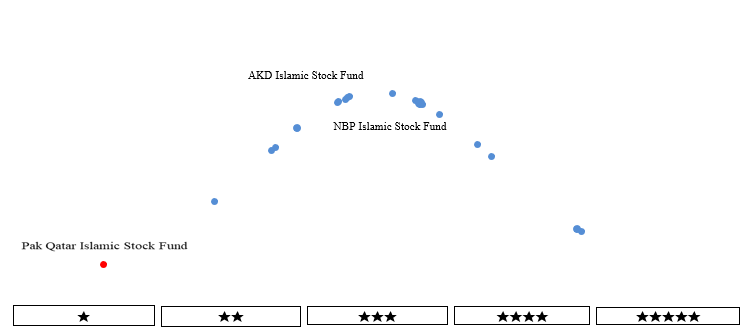

Date: 30-Sep-25 PACRA ASSIGNS STAR RANKING TO PAK QATAR ISLAMIC STOCK FUND

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Islamic Equity Fund | ||

| Total Fund In Category | 21 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (30-Sep-25) | Previous (21-Mar-25) | |

| Ranking | 1-Star | 1-Star | |

| Rating Rationale |

In FY25, Pakistan’s Islamic equity market sustained strong momentum, with the KMI-30 index advancing ~46.23% by end-June. Macro conditions improved markedly as the $7 billion IMF Extended Fund Facility stayed on track, with disbursements exceeding $2 billion and the second review unlocking ~$1 billion in May. Inflation eased to ~3.2% by June, prompting the SBP to reduce the policy rate from 22% to 11%, creating some of the strongest positive real rates in recent history. Concurrently, forex reserves rose to USD 14.51 billion, above IMF thresholds, covering ~2.5 months of imports. The stabilization narrative attracted renewed foreign capital, particularly into Shariah-compliant large-caps.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-25 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |