|

Press Release

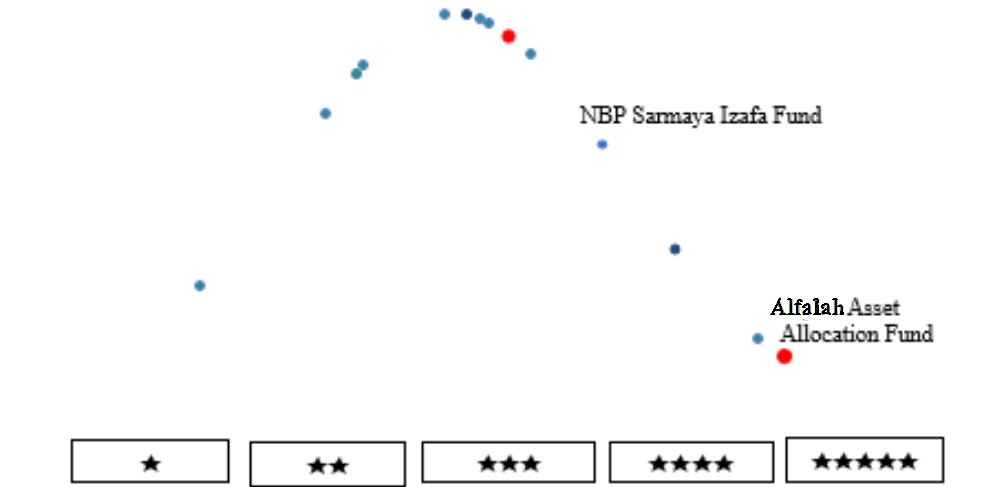

Date: 21-Oct-25 PACRA Withdraws Rankings of Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund)

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 11 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (21-Oct-25) | Previous (28-Feb-25) | |

| Ranking | - | 5-Star | |

| Rating Rationale |

Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund) was an open-ended equity scheme launched on July 24, 2006. The aim of the Fund is to provide investors with an opportunity to earn long-term capital appreciation optimizing through broad mix of asset classes encompassing equity, fixed income & money market instruments. In line with the decision of Alfalah Asset Management Limited (AAML), PACRA was requested to withdraw the performance ranking assigned to Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund). Consequently, PACRA hereby withdraws the performance ranking of the Fund with immediate effect. The previous star ranking of ‘5-Star’ was last announced on February 28, 2025.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-25 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

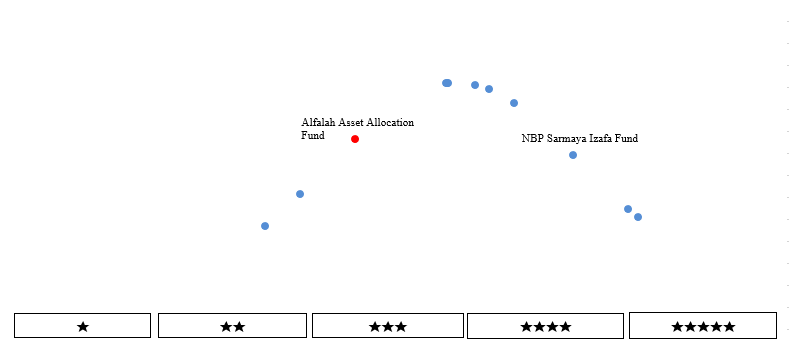

Date: 21-Oct-25 PACRA Withdraws Rankings of Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund)

3-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 11 | ||

| Performance Period | 3-Year | ||

| Dissemination Date | Current (21-Oct-25) | Previous (28-Feb-25) | |

| Ranking | - | 3-Star | |

| Rating Rationale |

Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund) was an open-ended equity scheme launched on July 24, 2006. The aim of the Fund is to provide investors with an opportunity to earn long-term capital appreciation optimizing through broad mix of asset classes encompassing equity, fixed income & money market instruments. In line with the decision of Alfalah Asset Management Limited (AAML), PACRA was requested to withdraw the performance ranking assigned to Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund). Consequently, PACRA hereby withdraws the performance ranking of the Fund with immediate effect. The previous star ranking of ‘3-Star’ was last announced on February 28, 2025.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-25 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

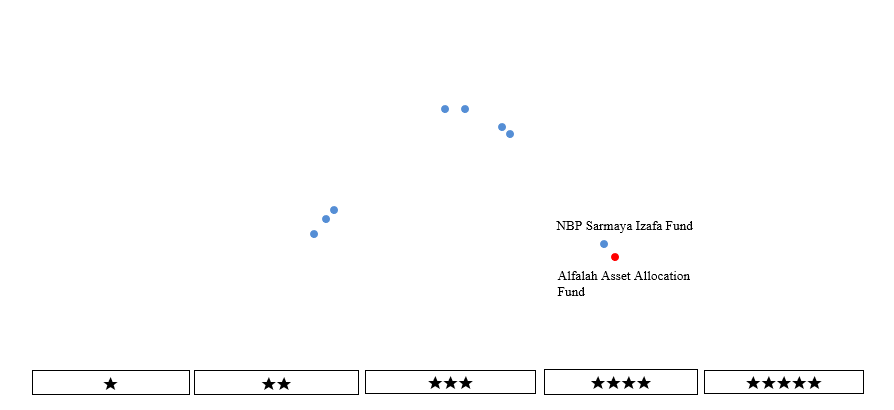

Date: 21-Oct-25 PACRA Withdraws Rankings of Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund)

5-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Asset Allocation Fund | ||

| Total Fund In Category | 11 | ||

| Performance Period | 5-Year | ||

| Dissemination Date | Current (21-Oct-25) | Previous (28-Feb-25) | |

| Ranking | - | 4-Star | |

| Rating Rationale |

Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund) was an open-ended equity scheme launched on July 24, 2006. The aim of the Fund is to provide investors with an opportunity to earn long-term capital appreciation optimizing through broad mix of asset classes encompassing equity, fixed income & money market instruments. In line with the decision of Alfalah Asset Management Limited (AAML), PACRA was requested to withdraw the performance ranking assigned to Alfalah Asset Allocation Fund (Formerly: Faysal Asset Allocation Fund). Consequently, PACRA hereby withdraws the performance ranking of the Fund with immediate effect. The previous star ranking of ‘4-Star’ was last announced on February 28, 2025.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Usama Ali usama.ali@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-25 |

Sector Study | Mutual Funds | Mar-25 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |