Profile

Legal Structure

Daewoo Pakistan Express Bus Service Limited (‘DPEBSL’ or ‘the Company’) is an unlisted public limited company, incorporated in Pakistan on December 22, 1997, under the now-repealed Companies Ordinance, 1984 (now the Companies Act, 2017). The Company’s registered office is located at 231-Ferozepur Road, Lahore.

Background

DPEBSL was initially established as a subsidiary of Daewoo Corporation, South Korea. Later, in 2007, the Company was acquired by Sammi Corporation, South Korea. Subsequently, DPEBSL was acquired by Asia Pak Investments in 2011. Over the years, the Company has strategically expanded its footprint in the intercity bus transit segment, operating in three out of Pakistan’s four provinces. Iin 2014, the Company entered the logistics sector with the launch of ‘Daewoo FastEx,’ and it has since become one of the largest players in both industries. Additionally, DPEBSL has secured Operations and Maintenance (O&M) contracts for several Mass Transit projects across the country, further diversifying its business and strengthening its profile.

Operations

The Company commenced its commercial operations in April 1998. Since then, it has grown to become one of the largest inter-city bus operators in the country, currently managing a fleet of over 370 buses and 61 terminals, serving more than 6 million passengers annually. In addition, DPEBSL has strengthened its position in the courier and logistics sector through Daewoo FastEx, with a franchise network of over 200 delivery centers nationwide and a dedicated fleet of more than 185 trucks. In CY23, the Company handled 4.19 million shipments. Furthermore, DPEBSL has secured Operations and Maintenance (O&M) contracts for seven out of the ten Mass Transit projects currently operating in Pakistan.

Ownership

Ownership Structure

The majority of the Company's shares (90.93%) are owned by Liberty Daharki Power Ltd., which is ultimately controlled by Mr. Shaheryar Arshad Chishti (100%), through his wholly owned companies, Asiapak Investments Ltd. and TNB Power Daharki Ltd. The minority shareholders include Meezan Bank Ltd. (4.53%) and Mr. Sohail Elahi (4.53%).

Stability

Since its inception, the ownership structure of the Company has undergone several changes. The most recent transaction occurred in 2011, when Asiapak Investments Ltd. acquired the Company from Sammi Corporation, Korea. Since then, there have been no significant changes to the ownership structure. Currently, the Company's ownership is concentrated in the hands of Mr. Shaheryar Arshad Chishti, through his wholly owned entities. To further strengthen the stability of ownership, it would be beneficial to establish a formally documented succession plan.

Business Acumen

The primary sponsor of the Company, Mr. Shaheryar Arshad Chishti, is a seasoned investment banker and entrepreneur. He has held senior leadership roles in several international organizations and has made substantial investments in a variety of sectors, including energy, transportation, logistics, and real estate. His successful investment ventures and leadership capabilities highlight his strong business acumen across multiple industries.

Financial Strength

Mr. Shaheryar Arshad Chishti holds several strategic investments across various sectors through his wholly owned entity, Asiapak Investments Ltd. His portfolio includes significant stakes in K-Electric, Thar Coal Block-1, multiple Independent Power Producers (IPPs), and Bol Network. This diversified portfolio of well-established business entities underscores his considerable financial strength, providing the Company with strong support should the need arise.

Governance

Board Structure

The Board of Directors (the Board) comprises seven members including four non-executive directors, one of whom is a female director, and three executive directors. Mr. Shaheryar Arshad Chishti, the primary sponsor, is among the executive directors and also serves as the Chairman of the Board.

Members’ Profile

All members of the Board are seasoned professionals, bringing extensive expertise and experience from diverse sectors. Notably, Mr. Shaheryar Arshad Chishti, the Chairman, graduated from Ohio Wesleyan University and is a seasoned investment banker and entrepreneur. He has held senior leadership positions with renowned international organizations, including Citigroup and Nomura International, before establishing his own investment portfolio. Additionally, Mr. Yong Hee Lee has served in various executive roles, including CEO, at Sammi Corporation, South Korea, for over three decades. Mr. Darin Daniel Baur, a graduate of Harvard Law School, is an experienced investment banker who has worked with leading investment banking firms in Canada, Hong Kong, and the USA.

Board Effectiveness

The Board meets at least quarterly, following a pre-defined agenda, to oversee management’s performance and provide strategic direction. During each meeting, the management presents a detailed review of the performance of each business segment. The minutes of the meetings are accurately documented, and action points are communicated to the relevant stakeholders. Additionally, the Board has established two committees: i) the Audit Committee and ii) the Human Resource Committee. These committees support the Board in ensuring the development and implementation of effective risk assessment and mitigation strategies, and human resource policies.

Financial Transparency

M/S Yousuf Adil Chartered Accountants, a QCR-rated firm listed in the ‘A’ category on the SBP's panel of auditors, serve as the Company's external auditors. The auditors have issued an unqualified opinion on the Company's financial statements for the year ended December 31, 2023, indicating the Company’s compliance with applicable accounting policies and standards.

Management

Organizational Structure

The Company’s organizational structure is divided into several functional departments, including Human Resources, Marketing, Finance, Investment and Planning, Protocol and Public Relations, and Supply Chain. Additionally, each operational segment is organized as a separate business division, such as Urban Transport and Regulatory Affairs, Express Bus Service, FastEx, Workshops, and Waste Management. Each department and division follows a multilayered hierarchy and is led by a qualified Head of Department with relevant experience. All department heads report to the CEO, who, in turn, reports to the Board of Directors. Currently, all the key positions are filled.

Management Team

Mr. Faisal Ahmed Siddiqui serves as the CEO of DPEBSL. He holds a Master’s degree in Business Administration from Columbia University and has extensive experience in strategic planning, analysis, and business operations management. Prior to his current role, he worked as a Financial Modelling and Analysis Consultant at Convoy Solutions LLC, USA, and as Director of Fixed-Income Structuring and Trading at Credit Suisse, a global investment bank and financial services firm based in Switzerland. He is supported by a team of experienced professionals with specialized expertise in their respective fields and longstanding association with the Company. Notably, Mr. Anwer Shamim, the CFO, is a qualified Chartered Accountant with the Institute of Chartered Accountants of Pakistan (ICAP) and brings extensive experience in financial management. Furthermore, Mr. Waqar Asghar, president of intercity bus operations, is an experienced executive with expertise in franchise management and operations of leading global brands, Mr. Khurram Mirza, vice president of urban transport and regulatory affairs, has been associated with the Company for over two decades and possesses extensive experience in the transportation sector. Mr. Sajid Khan, vice president of the FastEx division, has held leadership positions with various logistics companies including Leopards Pakistan, OCS Pakistan, and TCS Pakistan.

Effectiveness

A well-defined organizational structure with clear responsibilities and reporting lines enhances the effectiveness of management. The Company has also established an Operational Committee, consisting of all department heads, which further strengthens management effectiveness. This committee facilitates focused and efficient operational decision-making by bridging gaps between departments, ensuring smoother coordination and execution.

MIS

The Company has implemented Oracle as its primary Enterprise Resource Planning (ERP) software, significantly improving the quality of transactional record-keeping and reporting. Additionally, the Company has established a dedicated e-ticketing platform to enhance customer convenience and facilitate seamless ticket purchasing.

Control Environment

The Company has established a robust mechanism to assess, report, and mitigate risks arising from its business operations. Additionally, a dedicated in-house internal audit department is responsible for evaluating the effectiveness of risk management and mitigation procedures, ensuring their proper implementation, and recommending improvements to enhance their efficacy. The internal audit department reports directly to the Board’s Audit Committee, ensuring both objectivity and independence in its operations.

Business Risk

Industry Dynamics

Pakistan’s transport sector is a key component of the broader services sector, contributing approximately 52.9% to the country's Gross Domestic Product (GDP) in FY24. The intercity bus transit segment is characterized by a mix of a few large, organized players operating fleets of around 50 to 500 vehicles, and many small, unorganized players with fleets of 1 to 50 vehicles and limited geographical reach. This segment faces intense competition due to low barriers to entry, requiring affordable pricing and high-quality services to sustain growth. Similarly, in the logistics services sector, consumers are increasingly gravitating toward providers that offer competitive pricing, reliable services, and technology-driven solutions such as real-time tracking of consignments. Notable players in the intercity bus transit segment include DPEBSL, Faisal Movers, Bilal Travels, and Niazi Express, among others. However, competition in the regulated segment, specifically in the provision of operations and maintenance services for government-owned mass transit projects, is limited, with only a few players possessing the capacity and expertise to manage such projects. Key players in this segment include DPEBSL and Veda Transit Solutions (Pvt.) Ltd.

Relative Position

Daewoo Pakistan has steadily expanded its presence across all the business segments in which it operates, establishing itself as one of the leading players in the road transport sector. The Company operates a fleet of over 370 buses on intercity routes, serving approximately 6 million passengers annually. Additionally, Daewoo Pakistan is the third-largest provider of logistics services, with a dedicated fleet of more than 185 trucks. In the regulated segment, DPEBSL holds a dominant market share of around 70%, having secured operations and maintenance contracts for seven of the ten mass transit projects currently operational in Pakistan. These include BRT Peshawar 1 & 2, Orange Line Lahore, Green Line and Orange Line Karachi, Multan Metro Bus Service, and Lahore Feeder Routes.

Revenues

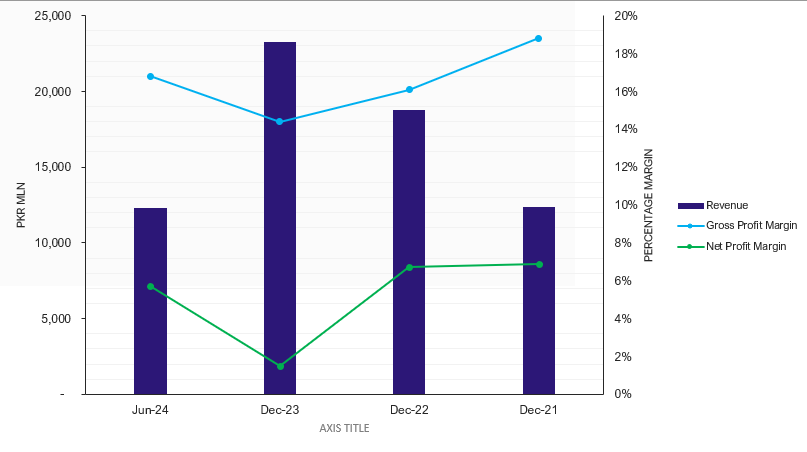

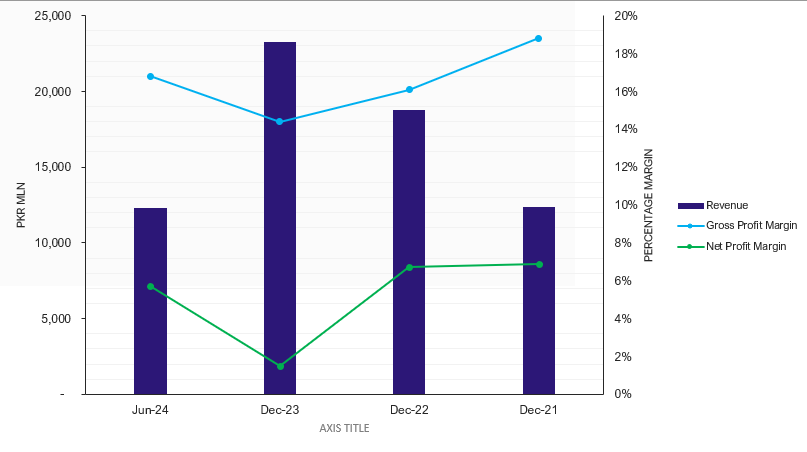

During CY23, the Company’s revenue grew by ~24% YoY and was recorded at PKR 23,253mln, compared to PKR 18,779mln in CY22. The growth was primarily driven by price adjustments in the intercity bus and regulated segments to pass on the increase in fuel prices while the volumetric indicators in the intercity bus segment including, the number of passengers (CY23, 6.25mln: CY22, 6.3mln), total trips (CY23, 189,875: CY22, 194,356), and average occupancy rates (CY23, 68.4%: CY22, 68.1%) remained stagnant. However, volumes increased in the relatively smaller logistics services segment. The non-regulated segment comprising intercity bus transit services and logistics services grew by ~ 26% during the year, accounting for ~51% of the overall revenue while the regulated segment grew by ~22% YoY, contributing ~49% to the overall revenue. Furthermore, during 1HCY24, the Company’s revenue was recorded at PKR 12,271mln, reflecting a modest growth of ~6% on an annualized basis.

Chart 1: Revenue & Margins

Margins

DPEBSL’s gross profit margin diluted to ~14.4% in CY23 compared to ~16.1% in CY22, primarily driven by a massive increase of ~30% in the fuel costs of the Company. This also trickled down to decrease the operating profit margin to ~7.9% during CY23 compared to ~9.4% during CY22. However, the Company’s net profit diluted to ~1.5% during the year compared to ~6.7% in CY22, attributable to the loss of ~PKR 808mln incurred by the Company on the disposal of investment in a joint venture, Daewoo Pakistan City Bus Service (Pvt.) Ltd, signifying a one-off event. DPEBSL recorded a profit after tax of PKR 345mln in CY23. Furthermore, during 1HCY24, the Company’s profitability matrix improved at all levels owing to a reduction in fuel prices and inflation as reflected by gross and net profit margins of ~16.8% and ~5.7% respectively.

Sustainability

The Company is well-positioned to capitalize on its already established strong standing in the regulated business segment. However, a focused medium-term strategy will be essential to foster volumetric growth within the intercity bus transit segment. Furthermore, the Company has entered into a joint venture agreement to participate in the bidding process for the proposed outsourcing of solid waste management services across various constituencies in Punjab. If awarded, this project could significantly enhance the Company’s financial profile.

Financial Risk

Working capital

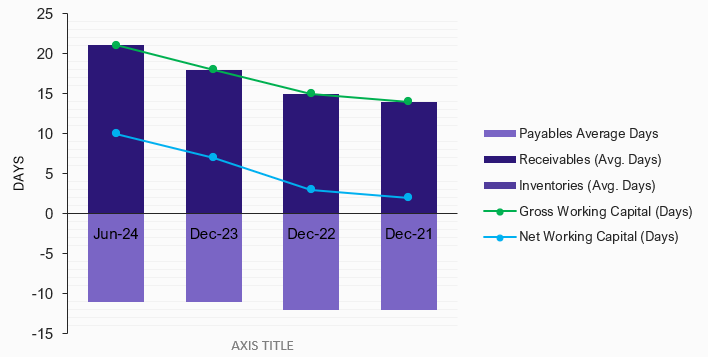

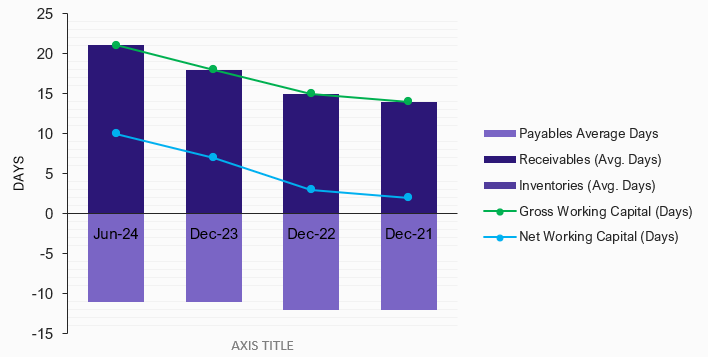

The Company’s working capital needs primarily emanate from funding its receivables. DPEBSL maintains a lean working capital cycle as reflected by the net working capital of ~9 days as of June 2024 (CY23, 7 days: CY22, 3 days). Furthermore, the short-term trade leverage of the Company was recorded at ~41.8% as of June 2024, reflecting sufficient room to borrow in case any such need arises.

Chart 2: Working Capital

Coverages

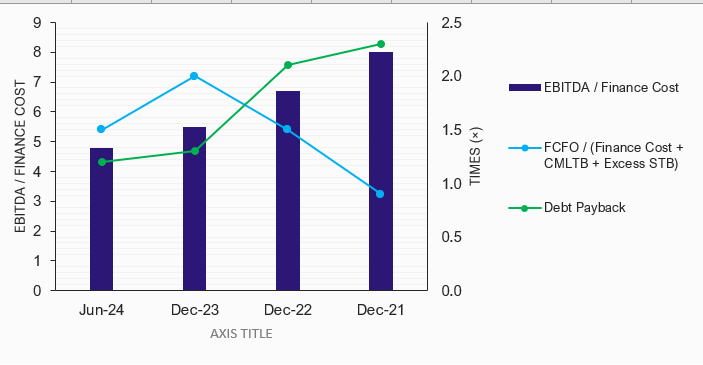

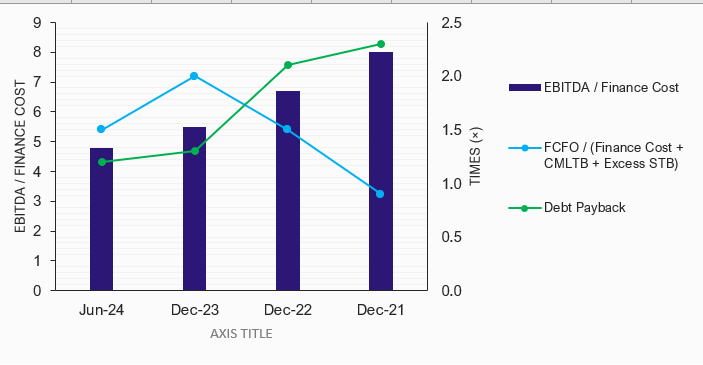

During CY23, the Company’s Free Cashflows from Operations (FCFO) increased to PKR 2,428mln compared to PKR 2,214mln in CY22 owing to an increase in EBITDA primarily on the back of higher finance cost adjustment. DPEBSL’s finance cost increased to PKR 116mln in CY23 compared to PKR 66mln in CY22 resulting in dilution of interest coverage ratio to ~4x compared to 5.2x in CY23. However, the Debt Payback ratio improved to 1.3 years in FY24 compared to 2.1 years in CY22. Furthermore, the Company’s interest and debt coverages remained at a comfortable level reflecting sufficient capacity available to service its debts.

Chart 3: Coverages

Capitalization

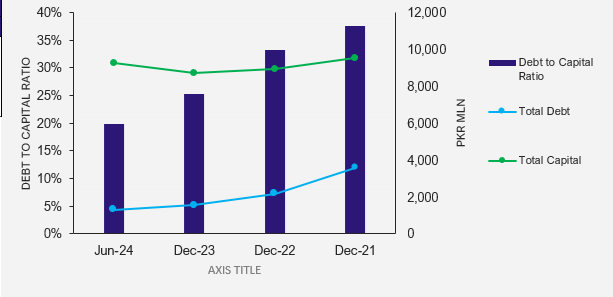

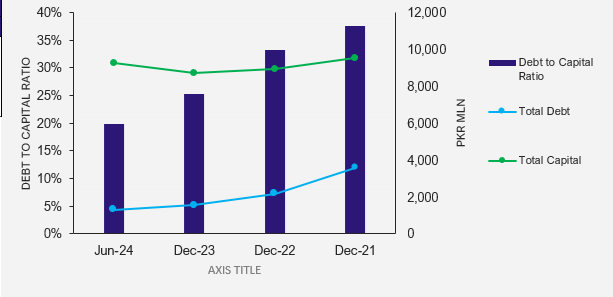

The Company maintains a modestly leveraged capital structure as reflected by the gearing of ~19.8% as of June 2024 (CY23, 25.3%: CY22, 33.2%). Debt is entirely of the long-term to fund expansion and procurement of buses. The Company’s borrowings were recorded at PKR 1,313mln as of June 2024. (CY23, PKR 1,541mln: CY22, PKR 2,167mln). Furthermore, the Company has provided a short-term advance of PKR 1,669mln to DW Pakistan (Pvt.) Ltd, a related party. DPEBSL’s consolidated equity was recorded at PKR 7,953mln as of June 2024, reflecting a sizeable capital base.

Chart 4: Capitalization

|