Profile

Legal Structure

Ibrahim

Fibres Limited ('IFL' or 'the Company'), established as a Public Limited

Company in 1986, is listed on the Pakistan Stock Exchange (PSX). As of the end

of January 2025, the Company's free float stands at approximately 5.0%. The

registered office of the Company is located at Ibrahim Centre, 1-Ahmed Block,

New Garden Town, Lahore - 54600, Pakistan.

Background

Incorporated

in 1986, Ibrahim Fibres Limited (IFL) is a publicly listed company on the

Pakistan Stock Exchange (PSX) and a market leader in Polyester Staple Fiber

(PSF) with a 73% market share. Over the years, the company expanded its

operations by establishing additional spinning mills and a power generation

company, which were later merged into a single entity, Ibrahim Fibres Limited,

in 2000. IFL operates one of Pakistan’s largest integrated polyester production

facilities, with a diversified portfolio spanning polyester fiber, textile

yarn, and power generation. The company’s strategic focus on vertical

integration, operational efficiency, and innovation has driven its long-term

growth and industry leadership. With state-of-the-art manufacturing, a strong

distribution network, and sustainable business practices, IFL remains a key

player in Pakistan’s textile value chain, catering to domestic and

international markets.

Operations

Ibrahim

Fibres Limited specializes in the production and marketing of Polyester Staple

Fibre (PSF) and blended yarns. The Company’s manufacturing facilities are

strategically located in Shahkot, near Faisalabad. As of the latest available

data, Ibrahim Fibres has a total polyester production capacity of approximately

390,600 tons per annum (TPA), while its spinning operations comprise around

240,192 spindles.

Ownership

Ownership Structure

The

Ibrahim Group maintains a majority ownership stake of approximately 91.80% in

Ibrahim Fibres Limited, primarily through its holding company, Ibrahim Holdings

(Private) Limited.

Stability

The

Ibrahim Group strategically established Ibrahim Holdings (Pvt.) Limited to

oversee succession planning and optimize investment management across its

subsidiary and associated companies, including Allied Bank Limited. This

structured approach enhances corporate governance, ensuring financial stability

and long-term sustainability for Ibrahim Fibres Limited.

Business Acumen

The sponsors of

Ibrahim Fibres Limited possess over five decades of extensive experience in the

textile industry, complemented by professional expertise in banking, finance,

and the power sector. This diverse industry exposure strengthens the Company’s

strategic decision-making and operational resilience.

Financial Strength

The

Ibrahim Group maintains a robust financial position, with a strong net worth

underpinning its business operations. The sponsors have consistently

demonstrated both the willingness and capacity to support Ibrahim Fibres

Limited, as evidenced by past financial assistance, including an interest-free

loan to sustain operations. Additionally, the group holds a majority stake of

approximately 90% in Allied Bank Limited, further reinforcing its financial

strength and strategic influence in the banking sector.

Governance

Board Structure

Ibrahim

Fibres Limited is governed by a seven-member Board of Directors, led by

Chairman Mr. Sheikh Mukhtar Ahmad. The board structure comprises four

representatives from the Ibrahim Group, ensuring strategic alignment with the

majority shareholders, alongside two independent directors who contribute to

enhanced corporate governance, oversight, and regulatory compliance.

Members’ Profile

Mr.

Sheikh Mukhtar Ahmad, Chairman of both Ibrahim Fibres Limited and the Ibrahim

Group, brings over 63 years of extensive experience in founding and

successfully managing various industrial and financial enterprises. In addition

to his leadership at Ibrahim Fibres, he serves on the boards of other group

companies, contributing to strategic decision-making across the organization.

The Board of Directors collectively possesses substantial industry expertise

and diversified professional experience, with long-standing tenures that

reinforce stability and continuity in the Company’s governance.

Board Effectiveness

To

ensure robust oversight, three key committees—Audit, Human Resources, and

Nomination—are actively engaged in governance matters. Member participation in

meetings remains consistently strong, reflecting a commitment to effective

decision-making. Additionally, the Board facilitates a Directors’ Training

Program throughout the year, designed to enhance the expertise and strategic

acumen of its members, thereby enabling them to fulfill their responsibilities

with greater proficiency and impact.

Financial Transparency

The

external auditors of the Company, M/s. Yousuf Adil – Chartered Accountants,

have issued an unqualified audit opinion on the financial statements for the

period ending December 31st, 2023. Furthermore, it is noteworthy that the

Company has transitioned its financial reporting period from a fiscal year to a

calendar year. The audit for the calendar year 2024 (CY24) is currently in

progress and will be finalized in due course.

Management

Organizational Structure

Ibrahim

Fibres operates with a well-defined, functionally departmentalized

organizational structure, meticulously segmented into distinct units, including

polyester production facilities, spinning plants, and power generation plants.

Management Team

Mr. Mohammad Naeem Mukhtar serves as the Chief Executive Officer (CEO) of Ibrahim Fibres

Limited, bringing over 38 years of in-depth experience in finance, industrial

manufacturing, and corporate leadership. In addition to his role at Ibrahim

Fibres, Mr. Mukhtar is the CEO of Ibrahim Holdings (Pvt.) Limited and holds directorial

positions in several other companies within the Ibrahim Group, contributing his

expertise in strategic oversight and organizational growth. Mr. Mohammad Naeem Asghar,

the Chief Financial Officer (CFO) of Ibrahim Fibres, has been a key figure in

the company for the past 34 years, with 12 years of dedicated service as CFO.

His extensive experience in financial management, coupled with his deep

understanding of the company’s operations, has been instrumental in navigating

the financial complexities of the business. The senior management team at

Ibrahim Fibres is distinguished by its long-standing tenure and proven track

record, reflecting a profound commitment to the company’s success and sustained

growth. Their collective expertise and leadership have played a critical role

in the company’s industry leadership and strategic direction.

Effectiveness

Senior

management conducts meetings on an ad-hoc basis, strategically convening to

deliberate on key matters and drive informed decision-making processes.

MIS

The company has implemented robust and seamlessly integrated systems, adopting Oracle as its enterprise resource planning (ERP) solution. This strategic integration enhances operational efficiency, ensures data accuracy, and facilitates real-time decision-making. By leveraging Oracle’s advanced capabilities, the company generates comprehensive, insightful, and data-driven MIS reports, empowering management with valuable analytics for informed strategic planning and performance optimization.

Control Environment

Ibrahim

Fibres maintains a dedicated internal audit function to ensure objective

oversight and accountability. The Company also boasts a highly skilled quality

control department, further supported by its ISO 9002 certification,

demonstrating its commitment to maintaining the highest standards of quality.

Business Risk

Industry Dynamics

As of 2023, global polyester fiber production reached

approximately 71.1 million metric tons, representing 57% of total global fiber

output. This reflects a steady increase from ~63 million metric tons in 2022,

when polyester accounted for 54% of total fiber production, reinforcing its

position as the dominant fiber in the global textile industry. Global demand

for Polyester Staple Fiber (PSF) is expected to remain favorable, with market

projections estimating the PSF sector's size to reach USD 3,024.3 million by

2026. The primary raw materials for PSF, namely Pure Terephthalic Acid (PTA)

and Mono Ethylene Glycol (MEG), are derived from crude oil, leading to price

fluctuations that contribute to the inherent price volatility of PSF.

Consequently, profit margins are heavily influenced by international price

trends and exchange rate fluctuations. Notably, over 80% of global PSF

production is concentrated in China, India, and Southeast Asia, regions that

are also the primary exporters of the product. In CY23, polyester fiber

production contracted by approximately 5.0%, driven by subdued demand and a

broader economic deceleration. In contrast, imports of polyester fiber

experienced a notable year-on-year (YoY) increase of around 10%. Local sales in

CY24 totaled 343,127 tons, reflecting a decline of approximately 10.8% compared

to 384,673 tons in CY23. This decrease is attributed to the ongoing challenges

in domestic production amid the prevailing market conditions.

Relative Position

Pakistan’s

Polyester Staple Fiber (PSF) industry is primarily dominated by three key

players: Ibrahim Fibres Limited (IFL), Lucky Core Industries Limited, and

Rupali Polyester. Among these, Ibrahim Fibres holds the largest market share at 73%, solidifying its position as the industry leader. Lucky Core Industries

Limited follows with a 24% market share, while Rupali Polyester accounts for 3%.

IFL’s market dominance is driven by its large-scale production capacity,

advanced manufacturing technology, and vertically integrated operations,

allowing it to achieve cost efficiencies and supply chain stability. The

company’s extensive customer base, strong distribution network, and focus on

quality standards further reinforce its competitive edge. In contrast, competitors

operate on a smaller scale, with relatively limited market penetration.

With

polyester continuing to be the most widely used synthetic fiber, IFL remains

well-positioned to capitalize on future growth opportunities, benefiting from

its strong industry presence, financial resilience, and strategic expansion

plans.

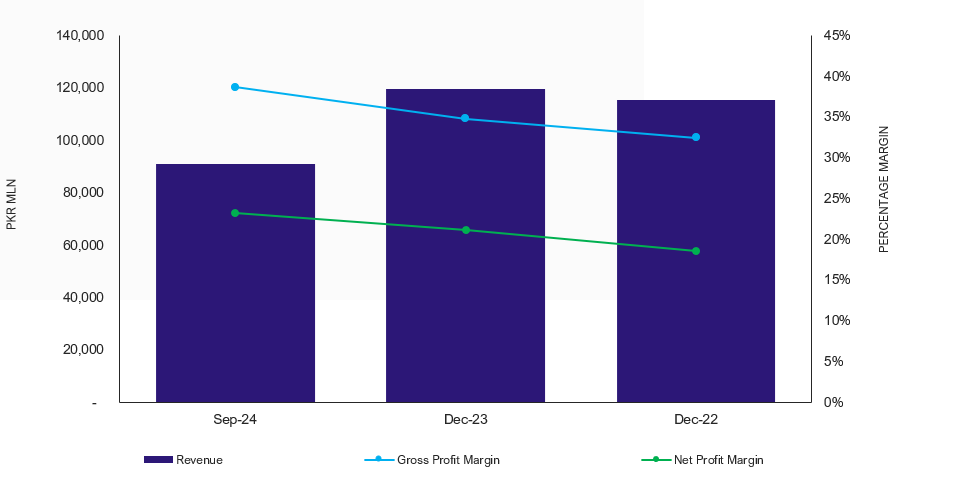

Revenues

Ibrahim

Fibres Limited (IFL) maintains a stable revenue profile, with the Polyester

Staple Fiber (PSF) segment contributing 64% of total sales in CY24, while the

spinning segment accounts for 36%. For 9MCY24, net sales stood at PKR 91.04

billion, reflecting a 1.4% growth over CY23 (PKR 119.76 billion). During

9MCY24, Polyester sales reached 156,355 tons (PKR 57.17 billion), while Textile

sales totaled 43,650 tons (PKR 33.85 billion). IFL’s diversified revenue mix,

operational efficiency, and strategic pricing approach support its resilience

and stable performance amid evolving industry conditions.

Margins

During

9MCY24, the Company's gross margins exhibited a slight improvement, reaching

approximately 7.7% (CY23: ~7.5%). Meanwhile, operating margins remained stable

at around 5% in both 9MCY24 and CY23. Notably, the net profit margin

strengthened to ~1.9% in 9MCY24 (CY23: ~0.3%), primarily driven by exchange

rate stability and reduction in borrowing cost.

Sustainability

Ibrahim

Fibres Limited remains a financially robust and strategically agile entity,

well-equipped to sustain long-term growth. While expansion plans are currently

on hold pending industry stabilization, the Company’s strong forecasting and budgeting

framework provides a solid foundation for navigating economic uncertainties.

Additionally, IFL benefits from a well-diversified product portfolio,

encompassing Polyester Staple Fiber (PSF), spinning, and power generation

segments, which collectively enhance revenue stability and mitigate

sector-specific risks. By maintaining a data-driven and risk-mitigated

approach, IFL is well-positioned to uphold its market leadership and long-term

business viability while capitalizing on evolving industry dynamics.

Financial Risk

Working capital

The

Company’s working capital requirements are primarily driven by inventory

procurement of key raw materials, including Pure Terephthalic Acid (PTA), Mono

Ethylene Glycol (MEG), cotton, and viscose, which are financed through a

combination of internal cash generation and short-term borrowings. The Company

maintains a historically efficient net working capital cycle with minimal

receivables exposure. During 9MCY24, the net working capital cycle improved,

with working capital days decreasing to 76 days (CY23: 82 days). This

improvement is primarily attributable to optimized inventory management,

efficient procurement strategies, and stable supply chain dynamics, allowing

the Company to maintain leaner inventory levels without disrupting production.

The continued focus on working capital efficiency enhances liquidity, reduces

reliance on short-term financing, and strengthens overall financial resilience.

Coverages

During

9MCY24, the Company’s Free Cash Flow from Operations (FCFO) stood at PKR 6,220

million (CY23: PKR 7,589 million), reflecting an increase attributed to changes

in working capital and operating cash flows. The interest coverage ratio also

improved, reaching 5.7x (CY23: 5.1x), demonstrating an enhanced capacity to

cover interest expenses with operating income. The core coverage ratio remained

stable at 3.1x (CY23: 3.1x), indicating consistent financial performance in

relation to its core obligations and operational efficiency.

Capitalization

IFL’s capital

structure is characterized by a low leverage profile, with short-term debt

accounting for 58.7% of the total debt book in 9MCY24. During CY23, the Company

maintained a leverage ratio of 21.4%, with short-term borrowings comprising

over 65% of the total debt. However, in 9MCY24, the proportion of short-term

debt decreased to 58.7%, and the leverage ratio improved to 16.4%. This

reduction in short-term borrowings reflects the Company’s strategic focus on

debt management and improving its debt maturity profile, which enhances

financial stability and reduces refinancing risk.

|