Profile

Legal Structure

Malik MIJ Chunxing Resources Recycling Co. Limited (MMC or 'the Company') is a public unlisted company. The registered office of the Company is

situated at Building # 08-CCA1, 3rd Floor, Street # 23, Phase 6, DHA, Lahore, Pakistan, and its plant is located at Faisalabad Industrial City Plot No. 50, Sahianwala

Interchange, District Faisalabad, Punjab.

Background

The company was incorporated in Pakistan on August 05, 2014, as a private limited company under the Companies Ordinance, 1984 (Repealed with the

enactment of the Companies Act, 2017 on May 30, 2017) vide the certificate of incorporation no.009145. Subsequently, it was converted into a public limited Company

on July 08, 2015.

Operations

The Company is principally engaged in the business of recycling & disposal of used lead acid batteries, lead plates, lead paste, and powder as well as

manufacturing and sale of bullion and refined lead. The intsalled capacity to produce refined lead is 50,000 tons per annum.

Ownership

Ownership Structure

The Company is jointly ventured by Jiangsu New Chunxing Resource Recycling Co., MIJ International, and Mr. Babar Waheed Malik. Jiangsu

New Chunxing Resource Recycling Co. having 45.82% of the share, is incorporated outside Pakistan and the company's registered address is "Circular Economy

Industrial Park, Pizhou, Jiangsu province, China". MIJ International is also incorporated outside Pakistan and the company's registered address is "Unit No.2609 JBC5

Plot # JLT-PH2- WIA, Jumeirah Lakes Towers, Dubai-UAE" and has 18.67% shareholding. The remaining 35.5% of the shareholding is divided equally among Mr.

Babar Waheed Malik (CEO) and Mr. Saeed Rafiq

Stability

The associated company ‘Jiangsu New Chunxing Resource Recycling Co., Ltd’ has experience of 3 decades in producing and refining secondary lead. It comes

under the umbrella of Jiangsu Chunxing Alloy Group Co., Ltd, a company with over 40 years of experience in processing ULAB (Used Lead Acid Battery). The other

sponsor is MIJ International with a decade of experience in trading, processing, and producing ferrous and non-ferrous metals.

Business Acumen

The sponsors of the Company have substantial experience in global metal trading and the recycling & disposal of used lead acid batteries, lead plates, lead paste, and lead powder

industry.

Financial Strength

Jiangsu New Chunxing Resource Recycling Co., Ltd is a top-ranked recycling company in China with over 40 years of experience in processing

ULAB (Used Lead Acid Battery). The present ULAB treatment capacity is 1 million MT/annum and the secondary lead output capacity is 600,000 MT/annum. MIJ

International is a Dubai-based metal merchant specializing in trading, processing, and production of ferrous and non-ferrous metals. MMC has an equity base of PKR 4.5bln as of Dec-24.

Governance

Board Structure

The Company’s board consists of five members, including four non-executive directors. Mr. Babar Waheed serves as the chairman of the board. Board meetings are held as needed, and no committees have been formed. Additionally, there is no formal policy for recording board minutes. Voluntary compliance with the Code of Corporate Governance could provide additional benefits.

Members’ Profile

Mr. Babar Waheed is the Company's Chairman and a seasoned business professional with extensive entrepreneurial experience in both UAE and

Pakistan. All other members are well qualified with considerable Lead recycling business experience and a diversified skill mix.

Board Effectiveness

MIJ board is more of an advisory nature as all members on average possess 30 years of experience. The board has no formal committees but all

members are involved in and ensure their input in the decision-making process.

Financial Transparency

Hassan Farooq & Co., Chartered Accountants are the external auditors of the Company. The firm is QCR-rated. They gave an unqualified

opinion on the company’s financial statements for the year ended June 30, 2024. To futher enhance the transparency, it is recommended that MMC should consider to engage external auditors which belongs to the State Bank of Pakistan (SBP) category.

Management

Organizational Structure

The Company has an adequate Organizational structure. The departments are mainly divided into two categories under the umbrella of CEO; (I)

Accounts, Tax & Finance department supervised by Mr. Haider Abbas (CFO) & (II) Production and Operations managed by Mr. GUO (GM Operations).

Management Team

Mr. Babar Waheed (CEO) leads the management team. He has been associated with the lead business for the last 27 years and has played a key role

in the success of the Company. Mr. Haider Abbas is the CFO he is a fellow member of association of certified chartered accountants and posseses ample industry and professional experience.

Effectiveness

The Company has no management committees in place. However, senior management members meet on a daily basis to discuss ongoing issues and plans.

MIS

The Company has implemented two software, one is SQL web-based and the other one is Chinese software, convertible into two languages at a time.

Control Environment

The management has a strong control environment within the Company supplemented by a robust quality control system for its production

processes. Additionally, the Company has technical collaboration agreements with international firms to ensure that quality standards are adhered to.

Business Risk

Industry Dynamics

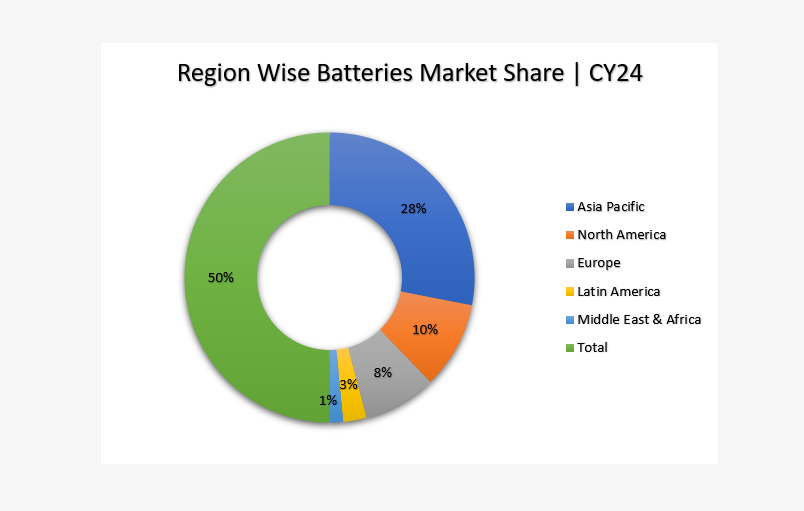

During CY24, the global batteries sector was valued at USD~146.2bln (CY23:

USD~125.4bln), a YoY increase of ~16.5%.

In terms of regions, the Asia Pacific batteries sector reached to USD~82.3bln in

CY24 (CY23: USD~70.4bln), a YoY increase of ~16.9%. Asia Pacific region

contributed ~56.1% to the global batteries market share during CY24.

In terms of industries, the automotive industry accounted for the majority share of

the batteries sector during CY24. The anticipated rise in the demand for lithium-ion

batteries in the end-use segment for passenger cars is expected to be supported by

rising awareness about the benefits offered by electric vehicles operating in regions

like Asia Pacific, Europe, and North America.

The global batteries sector is expected to reach to USD~680.9bln by CY34. The

growth rate of the market is expected to increase over the forecast period, owing to

increased demand for Electric Vehicles (EVs). The rapid growth of the EV market

represents an important driver for expanding the global batteries sector. EVs are

vehicles that run on electric motors, meaning they use batteries to store and supply

energy for propulsion. As of Dec’24, prices stood at USD 1,985/MT, with a further decline expected amid rising supply and weak Chinese demand.The demand for local recycled lead is closely tied to energy

deficits and trends in the auto sector. In FY24, lead-acid battery production

volume experienced a slight year-over-year decline due to reduced demand

stemming from the economic slowdown. However, in the first half of FY25, demand

rebounded as macroeconomic conditions stabilized, driven by the growing

adoption of solar energy solutions and a recovery in the automobile sector.

Chart 1: Global Market Share

Relative Position

The organized lead smelting segment is dominated by MMC, other players includes International Metal Industries (Pvt.) Ltd, Metpak Industries (Pvt.) Ltd.

Revenues

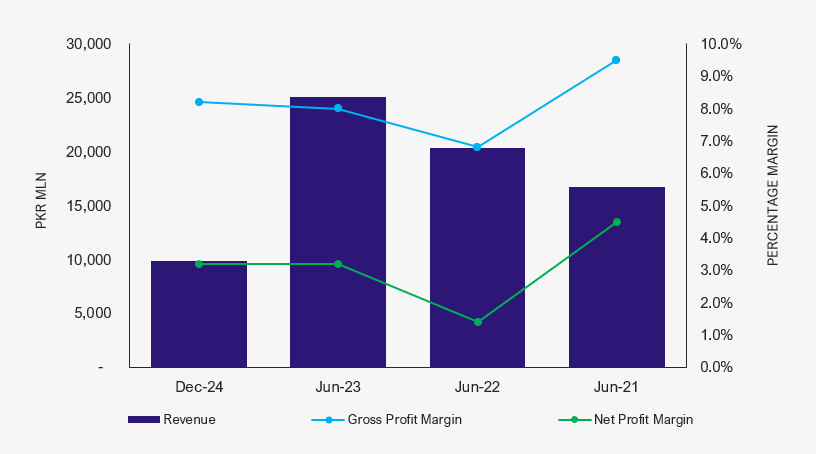

During FY24, the topline of the Company recorded at ~PKR 25bln (FY:23 ~ PKR 20.3bln) reflecting an increase of ~26%. This increase was primamrily attributed to price inflation and improved prodcution volumes. Capacity utilization was reached at ~74% in FY24 (FY23: 69%). During 6MFY25, the revenue stood at PKR 9,864 mln, reflecting a decline of ~21.4% YoY (FY24: PKR 25,098 mln). The drop was primarily due to lower sales volume due to cylicality effect as in winters demand and sale of lead acid battery remains at lower side. Exports contributed ~36% of total revenue, providing a hedge against inflation and exchange rate fluctuations.

Graph 1: Profitability Matrix

Margins

The Company's gross margin improved to 8.2% in 6MFY25 (FY24: 8.0%, FY23: 6.8%), driven by better cost efficiencies. Meanwhile, the net margin stood at 3.2% (FY24: 3.2%, FY23: 1.4%). Net profit reached PKR 320mln in 6MFY25 (FY24: PKR 808 million, FY23: PKR 289 million), benefiting from price adjustments and currency stabilization, leading to foreign exchange gains.

Sustainability

The company has a strong clientele in Pakistan as well as a wide network of resources and clientage through its associated companies' strong positions in

leading markets all around the world. Moving forward MMC also has an expansion plan to enhance its capacities from 50,000MT to 75,000 over the period of three years. The management has a proper budgeting and forecasting function in place, and it was observed that the Company's performance was aligned with the forcasted financial projections.

Financial Risk

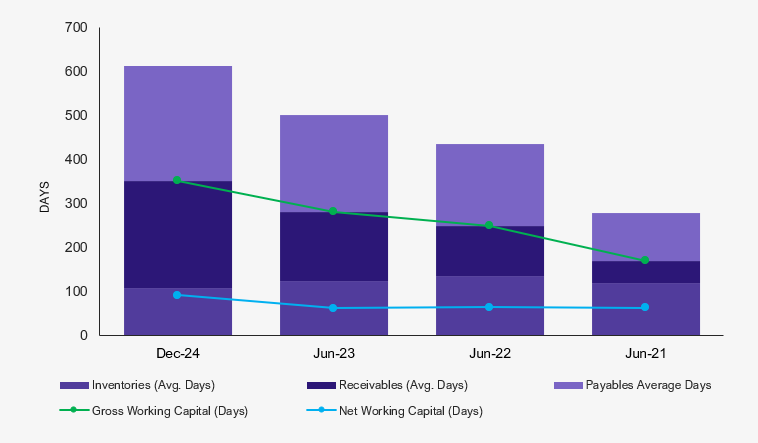

Working capital

During 6MFY25, inventory days stood at 108 days, reflecting an improvement from 124 days in FY24 and 135 days in FY23. Trade receivable days increased to 245 days (FY24: 158 days, FY23: 115 days), leading to a gross working capital cycle of 353 days (FY24: 282 days, FY23: 250 days). Net working capital days stood at 92 days, indicating a stretched working capital cycle. The short-term trade leverage stood at 17.1%, providing adequate room for further borrowing.

Graph 2: Working Capital Cycle

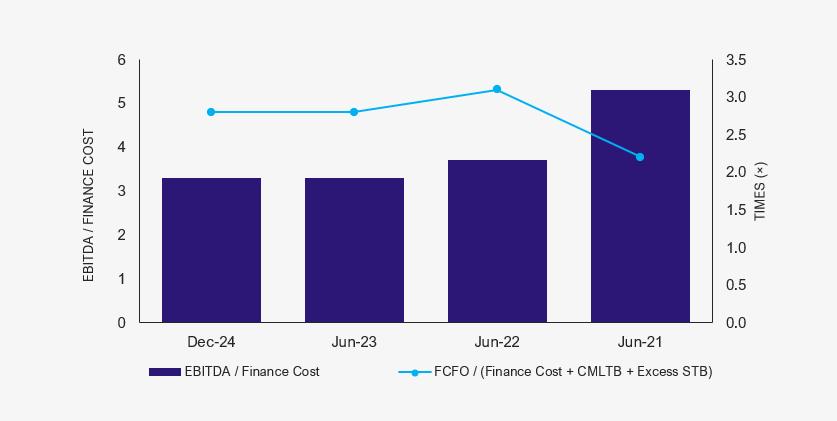

Coverages

he Company generated FCFO of PKR 627 million in 6MFY25 (FY24: PKR 1,474 million, FY23: PKR 1,368 million). However, the interest coverage ratio declined to 3.3x (FY24: 3.3x, FY23: 3.7x), reflecting higher finance costs. Similarly, the debt coverage ratio stood at 2.8x (FY24: 2.8x, FY23: 3.1x), while the debt payback ratio remained stable at 0.0x.

Graph 3: Financial Coverages

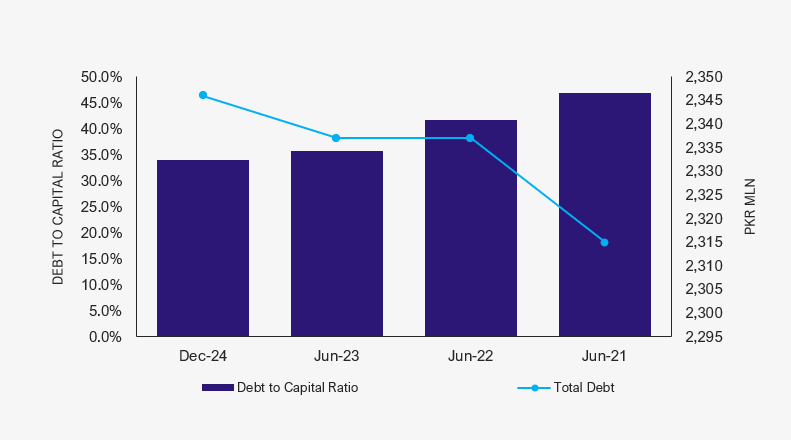

Capitalization

The Company maintains a leveraged capital structure, with a total borrowings-to-equity ratio of 34.0% in 6MFY25 (FY24: 35.6%, FY23: 41.7%), improving due to higher net equity from retained earnings. Short-term borrowings accounted for ~99.5% of total borrowings, standing at PKR 2,335 million in 6MFY25.

Graph 4: Capital Structure

|